-

chevron_right

chevron_right

Billions of public Discord messages may be sold through a scraping service

news.movim.eu / ArsTechnica · 2 days ago - 19:42 · 1 minute

Enlarge (credit: Getty Images)

It's easy to get the impression that Discord chat messages are ephemeral, especially across different public servers, where lines fly upward at a near-unreadable pace. But someone claims to be catching and compiling that data and is offering packages that can track more than 600 million users across more than 14,000 servers.

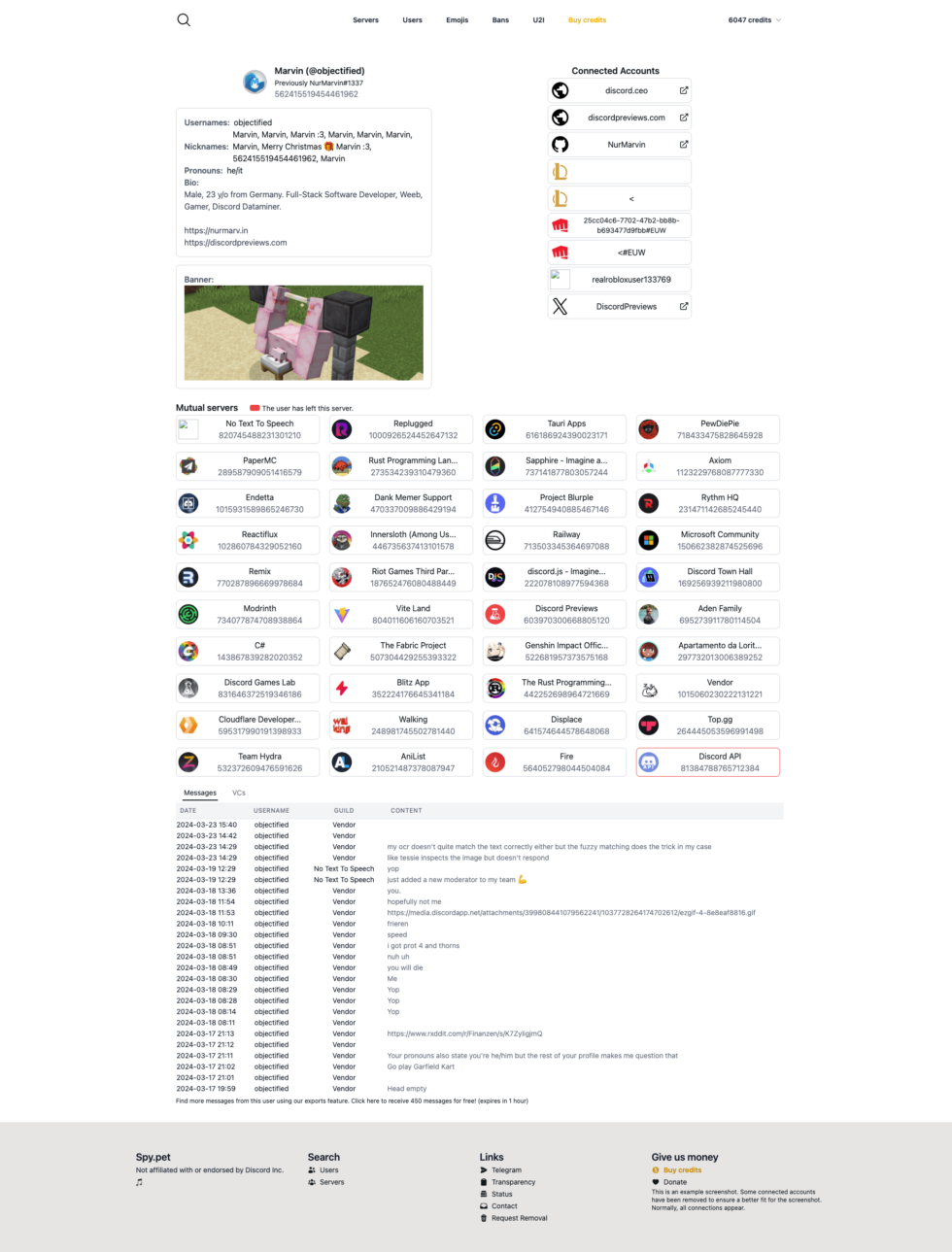

Joseph Cox at 404 Media confirmed that Spy Pet, a service that sells access to a database of purportedly 3 billion Discord messages, offers data "credits" to customers who pay in Bitcoin, Ethereum, or other cryptocurrency. Searching individual users will reveal the servers that Spy Pet can track them across, a raw and exportable table of their messages, and connected accounts, such as GitHub. Ominously, Spy Pet lists more than 86,000 other servers in which it has "no bots," but "we know it exists."

-

An example of Spy Pet's service from its website. Shown are a user's nicknames, connected accounts, banner image, server memberships, and messages across those servers tracked by Spy Pet. [credit: Spy Pet ]

As Cox notes, Discord doesn't make messages inside server channels, like blog posts or unlocked social media feeds, easy to publicly access and search. But many Discord users many not expect their messages, server memberships, bans, or other data to be grabbed by a bot, compiled, and sold to anybody wishing to pin them all on a particular user. 404 Media confirmed the service's function with multiple user examples. Private messages are not mentioned by Spy Pet and are presumably still secure.